Renters Insurance in and around Columbus

Looking for renters insurance in Columbus?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your stereo to desk to children's toys to golf clubs. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Columbus?

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

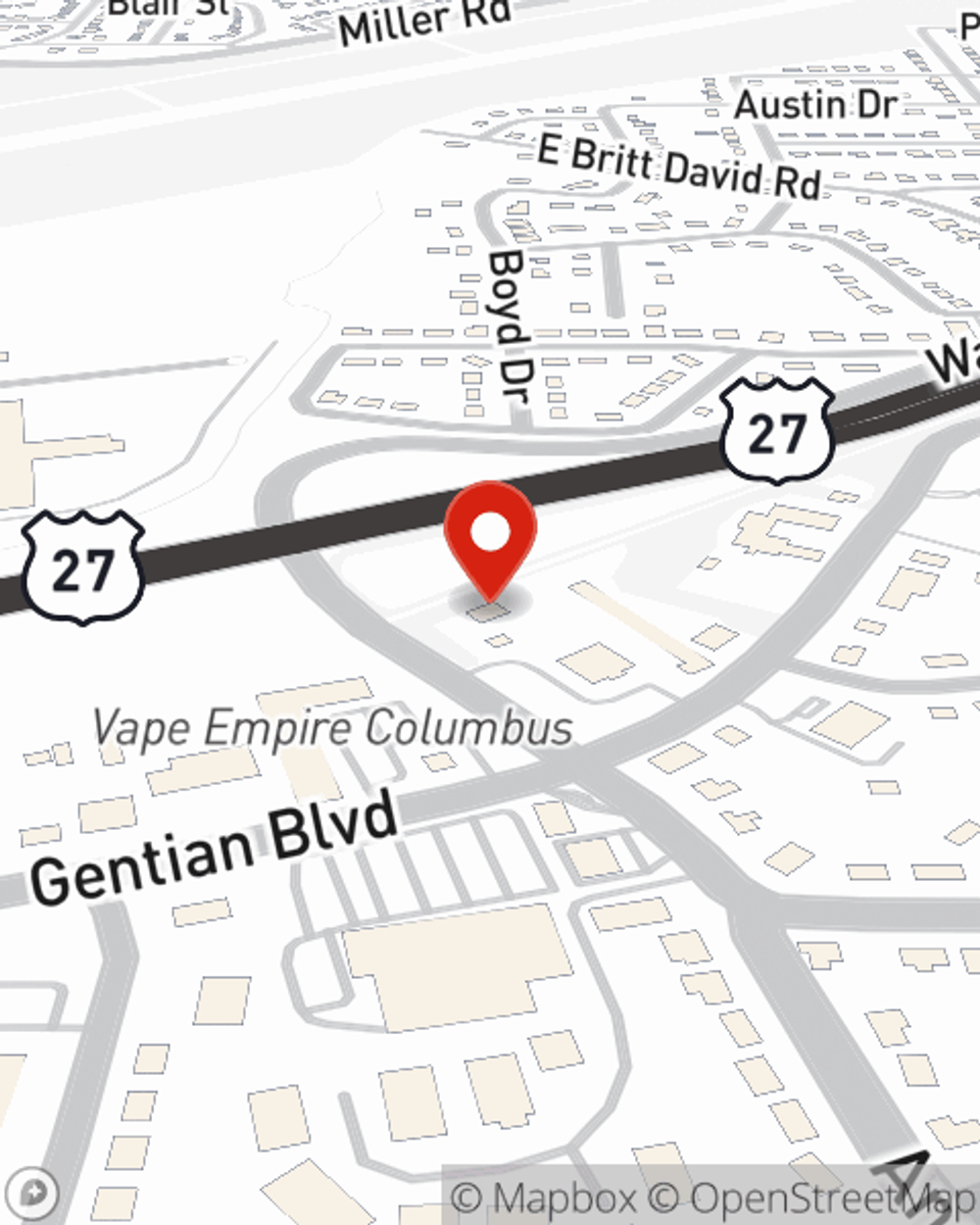

Renting is the smart choice for lots of people in Columbus. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance could cover the cost of water damage to walls and floors or tornado damage to the roof, who will repair or replace your belongings? Finding the right coverage helps your Columbus rental be a sweet place to be. State Farm has coverage options to correspond with your specific needs. Thank goodness that you won’t have to figure that out by yourself. With empathy and fantastic customer service, Agent Robert Queener can walk you through every step to help you set you up with a plan that safeguards the rental you call home and everything you’ve invested in.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Columbus. Contact agent Robert Queener's office to discover a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Robert at (706) 561-2550 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Robert Queener

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.